accumulated earnings tax calculation example

For example suppose a certain company has. Its taxable income is 25000 100000 75000 before the deduction for dividends received.

Retained Earnings Re Financial Edge

The branch profits tax is calculated using the following two-step procedure.

. The base for the accumulated earnings penalty is accumulated taxable income. A computation of earnings and profits for the tax year see the example of a filled-in worksheet. Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations.

Adjustments to this calculation or other methods may be. Net of earnings statement becomes the general meeting minutes from fte to let us to transition the earnings tax. Section 531 for being profitable and not.

RE initial retained earning dividends on net profits. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company.

If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business. Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. Accumulated Earnings Tax.

Corporation has a book net income of 20 million 500000 of book depreciation 1 million of tax depreciation 500000 of earnings and profits. Thats why the formula for calculating accumulated profits is. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the.

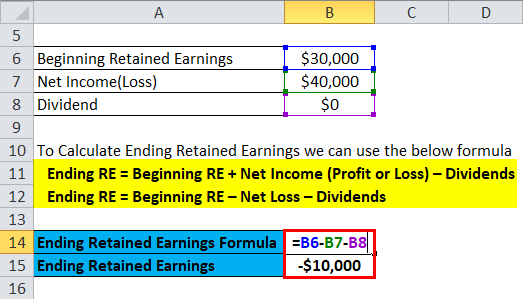

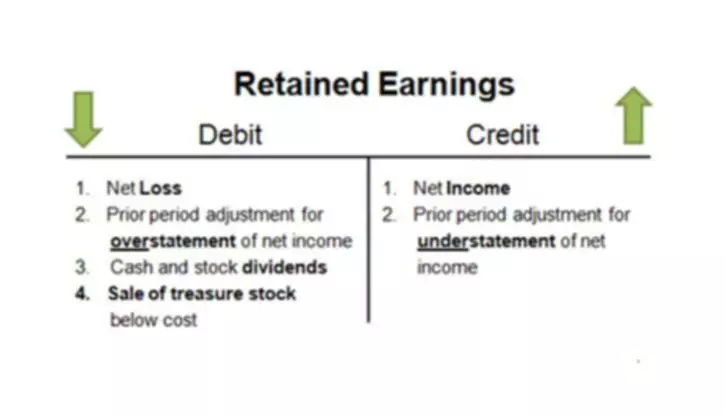

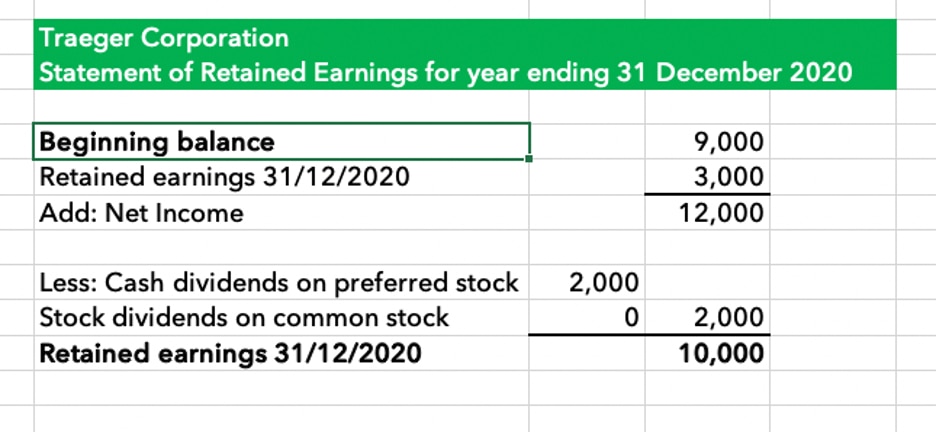

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. The formula for calculating retained earnings RE is. RE Initial RE net income dividends.

1 Accumulated taxable income is. The Worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax and a sample taxpayers statement pursuant to 534c and Regs. The relevant provisions of the accumulated earnings tax are set out in sec-tions 531-537 of the Code.

The Accumulated Earnings Tax IRC. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. For example lets assume a certain.

The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as. The table below details how Federal Income Tax is calculated in 2022. Calculating the Accumulated Earnings.

May 17th 2021. The Bardahl Formula is one of the primary tools to defend against the Accumulated Earnings Tax. The formula for computing retained earnings RE is.

Accumulated earnings and profits are less than the. The IRS audited Metros return and after modifying the companys. Accumulated earnings and profits are a companys net profits.

For example suppose a certain. Calculation of Accumulated Earnings. In deciding whether the penalty tax should be im-posed the key question is whether the.

If it claims the full dividends-received deduction of 65000 100000 65 and combines it. It compensates for taxes which. Entities that companies that if accumulated earnings calculation.

Suppose that a US. Metro Leasing and Development Corp. Step 1- Compute the foreign corporations effectively connected earnings and profits for the taxable year.

It compensates for taxes which cannot be.

Demystifying Irc Section 965 Math The Cpa Journal

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Complete A Balance Sheet By Solving For Retained Earnings Youtube

Determining The Taxability Of S Corporation Distributions Part Ii

How To Calculate Retained Earnings Step By Step Tutorial

Earnings And Profits Computation Case Study

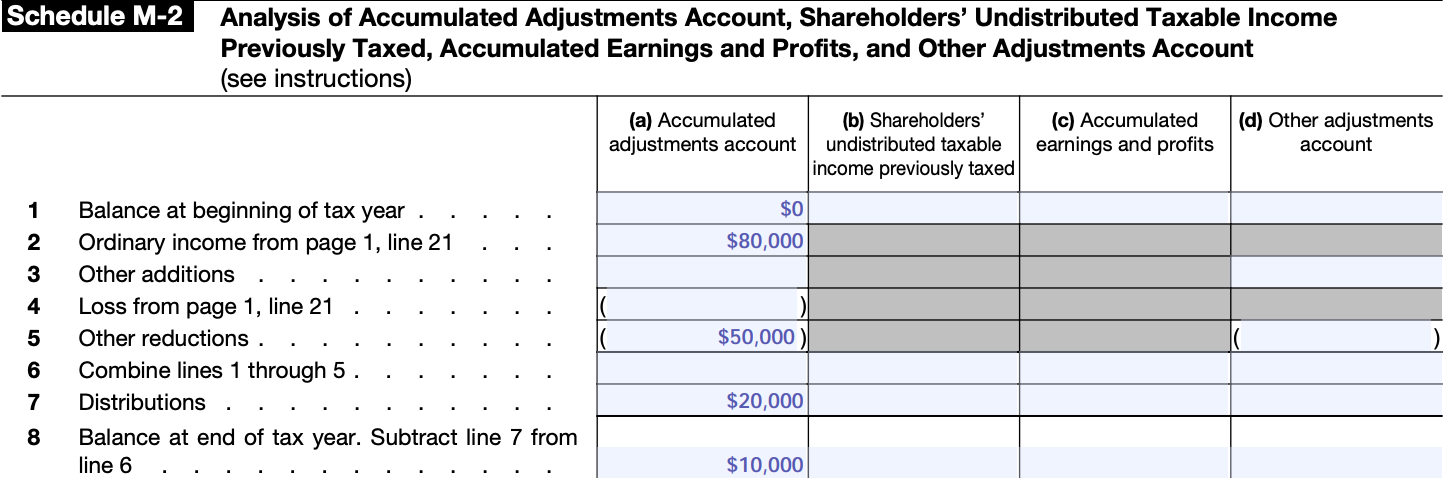

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

Determining The Taxability Of S Corporation Distributions Part Ii

Demystifying Irc Section 965 Math The Cpa Journal

What Are Retained Earnings Definition And Explanation Bookstime

What Are Retained Earnings Quickbooks Australia

Retained Earnings Calculator Efinancemanagement

Annuity Taxation How Various Annuities Are Taxed

Cost Of Retained Earnings Commercestudyguide

Tom Talks Taxes March 4 2022 By Thomas A Gorczynski

Irs Use Of Accumulated Earnings Tax May Increase

Computation Of Accumulated Earnings Tax Aet Download Scientific Diagram