how to find out why i have a tax levy

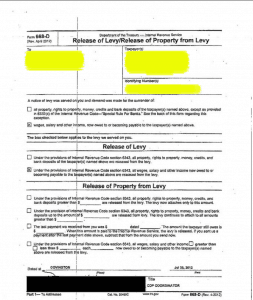

When applicable you will receive a notice from the IRS containing your rights of appeal in the. You paid your debt to the IRS in full.

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Add up your monthly levy allowances.

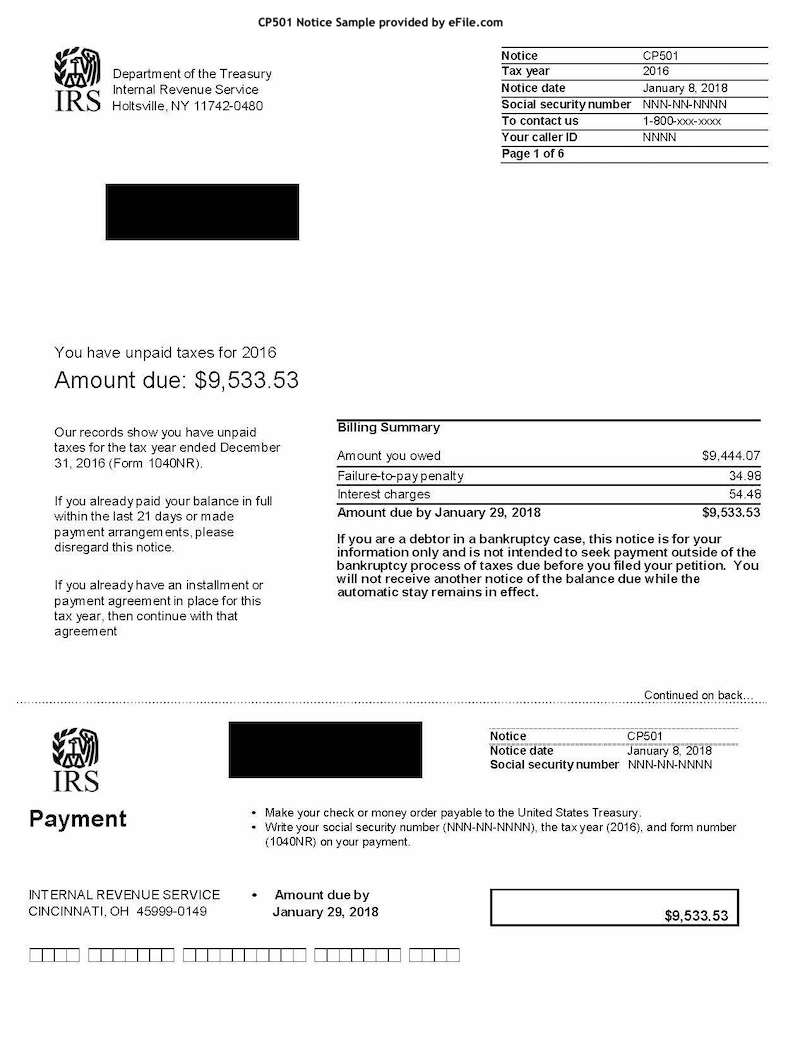

. Reasons to Appeal a Tax Levy. A levy occurs when the unpaid tax debt is owed to the IRS or another institution such as your bank or state. Subtract this figure from 05 of your monthly pay bill.

The IRS made a mistake and you dont owe the amount the IRS is imposing on you. Work out your total pay bill for the year to date. Tax Tools and Tips.

Call your bank to find out for sure. CALL 800-804-2769 FOR IMMEDIATE HELP. Tax Exempt Bonds.

A state tax levy is a collection method that tax authorities use. Show that the levy. Find any IRS examination reports or IRS notices you have that explained the tax so you can to discuss it.

Prove a financial hardship. It can garnish wages take money in your bank or other financial account seize and sell your. While you are at it make sure to get.

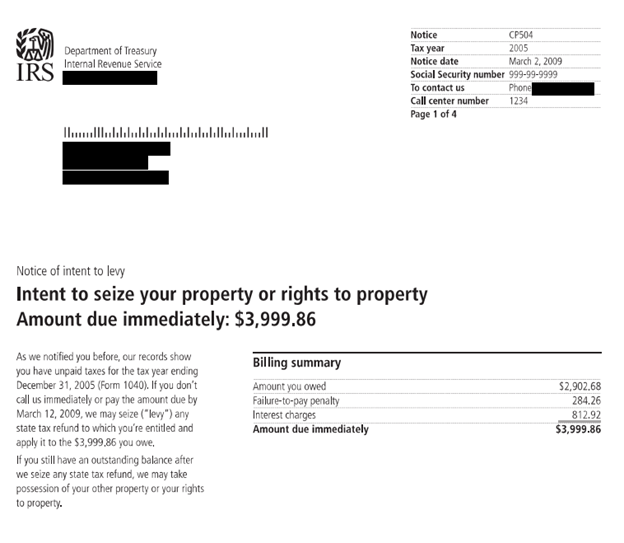

There are three things the IRS wants if. The period for collection had already ended when the levy was issued. You may have been levied by the state tax authorities or by a creditor if there is an outstanding judgment.

Some of the most common reasons for appealing include. A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous. Show that the money belonged to someone else.

You can ask the IRS to delay enforcement of the levy to give you time to. The IRS has to remove a tax levy if any of the following apply. Check e-file status refund tracker.

If you have failed to pay enough taxes any taxes at all or failed to. Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS can also release a levy if it determines that the levy is causing.

But whether youve received a Final Notice of Intent To Levy or you have actually had a paycheck levy heres how to get back on track. An IRS levy permits the legal seizure of your property to satisfy a tax debt. There are three main ways to release a California Franchise Tax Board bank levy.

All tax tips and videos. The Wisconsin Department of Revenue has no c ontrol of or information regarding these debts. For each of the following months.

Tax calculators.

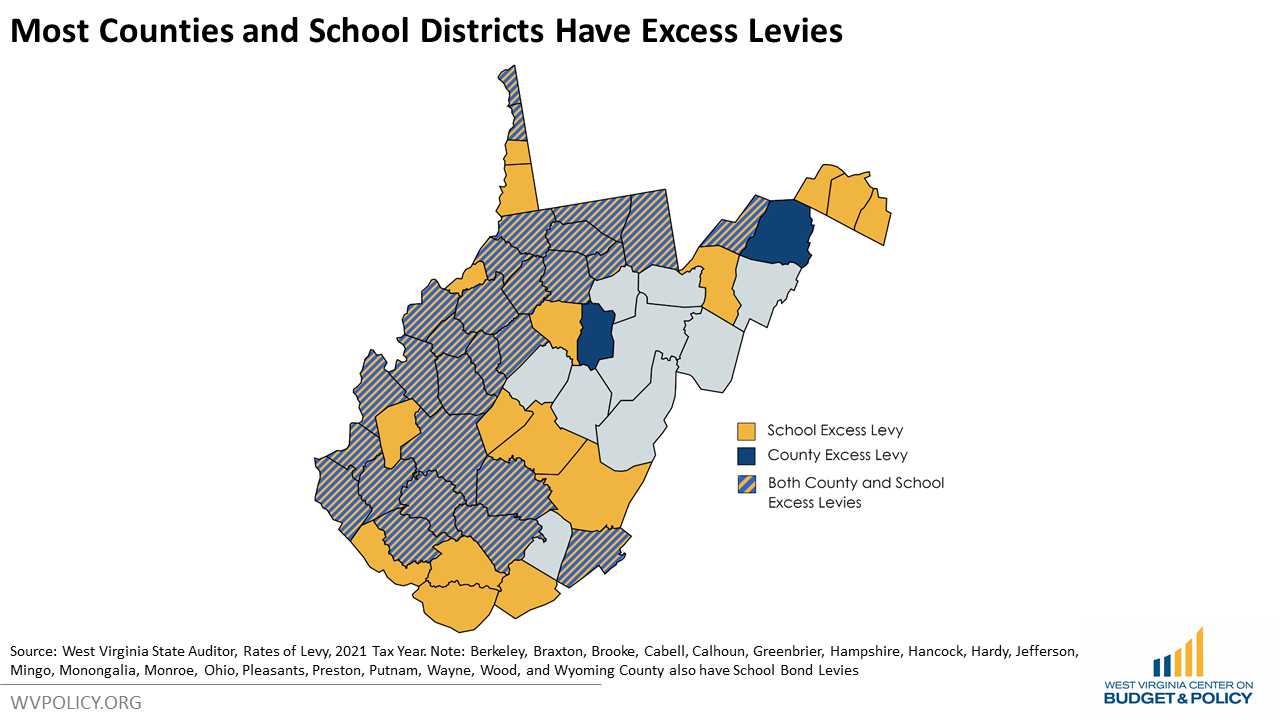

How Could 2022 Primary Election Levies Affect Your Property Taxes

Stressed About An Irs Tax Levy Our Experts Can Handle It

The Ultimate Guide To Irs Levies Damiens Law Firm

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Proposed Property Tax Amendment Could Jeopardize Local Excess And Bond Levies West Virginia Center On Budget Policy

Showalter And Co Cpa Irs Tax Levy Release

Tax Liabilities Difference Between A Tax Lien Levy Garnishment

What Is A Irs Tax Lien How To Stop A Irs Tax Lien Fidelity Tax

Tax Levy What It Is And How To Stop One Nerdwallet

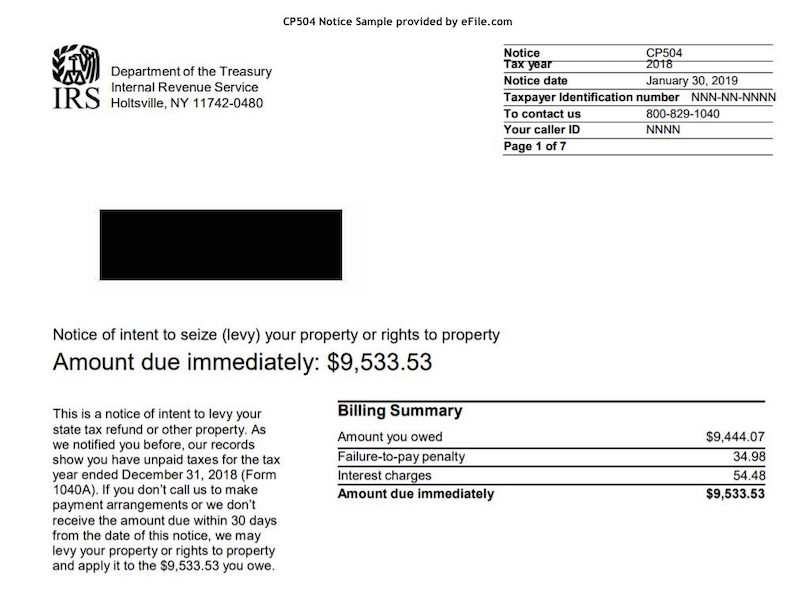

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

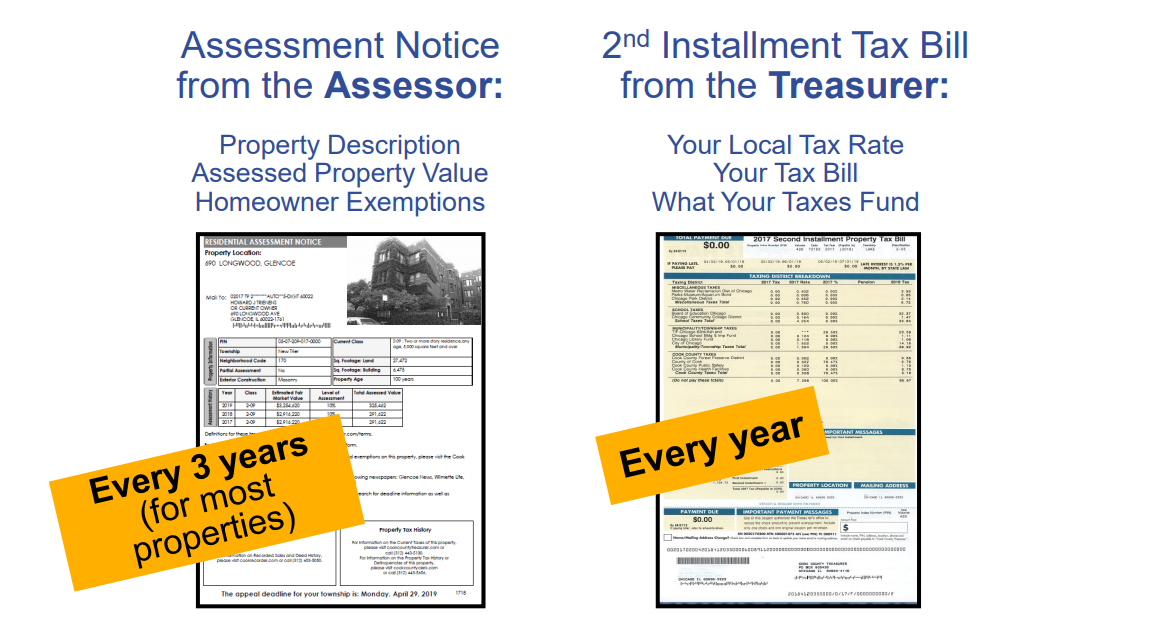

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Tax Levy Versus Tax Lien Onyx Tax Tax Relief Irs Representation Charleston Sc

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What Is A Tax Levy And How Do They Work Youtube

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group